Compute the Total and Annual Returns on the Described Investment

This investment by Facebook valued Jio Platforms at 46 lakh crore pre-money Enterprise Value. Investment bonds offer a wide choice of funds but have their own distinctive taxation treatment.

Calculating Return On Investment Roi In Excel

Compute the total and annual return on the following investment.

. Changes to our estimated variable consideration were not material for the periods presented. A return for a short period that is for a taxable year consisting of a period of less than 12 months shall be made under any of the following circumstances. Some funds may cover the costs associated with your transactions and your account by imposing fees and.

Returns and credits are estimated at contract inception and updated at the end of each reporting period if additional information becomes available. The UBTI with respect to any such trade or business shall not be less than zero when computing total UBTI. Performance data quoted represents past performance which is not a guarantee of future results.

Simple trusts which received a letter from the FTB granting tax-exempt status under RTC Section 23701d are considered to be corporations for tax purposes. It comprises any change in value of the investment andor cash flows or securities or other investments which the investor receives from that investment such as interest payments coupons cash dividends stock dividends or the payoff from a derivative or structured productIt may be measured either in absolute terms eg. In finance return is a profit on an investment.

Shareholder Fees and Annual. Investment bonds offer a wide choice of funds but have their own distinctive taxation treatment. Remember me on this computer.

Close Log In. Investment Analysis Portfolio Management by Reilly Brown 7e Solution Manual. We review debt investments quarterly for credit losses and impairment.

Impairment of Investment Securities. The total VaR is 35 and 29 less as of June 30 2017 and 2016 respectively than the sum of the separate risk categories in the table above due to the diversification benefit of the combination of risks. In addition to the subtractions listed below Virginia law also provides several deductions that may reduce your tax liability.

Including interest on facility loan payable the expense ratio is 187. See Schedule A Form 990-T. Log in with Facebook Log in with Google.

Must compute unrelated business taxable income UBTI including for purposes of determining any net operating loss deduction separately with respect to each trade or business. Under legislation enacted by the General Assembly Virginias date of conformity to the federal tax code will advance to December 31 2021. Two years after paying 3200 for shares in a startup company you sell the shares.

Facebooks investment translated into a 999 equity stake in Jio Platforms on a fully diluted basis. In the case of a change in the annual accounting period of a taxpayer a separate return must be filed for the short period of less than 12 months beginning. This partnership is aimed at accelerating Indias all-round development fulfilling the needs of Indians and Indian economy.

Religious or apostolic organizations described in RTC Section 23701k must attach a. A Returns for short period. The total annual expense ratio as a percentage of net assets attributable to common shares as of December 31 2021 is 177 excluding interest on facility loan payable.

Enter the email address you signed up with and well email you a. 1 Change of annual accounting period. Deferment of tax and simpler administration for the investor can make these investments attractive to individuals looking for.

Total one-day VaR for the combined risk categories was 207 million and 225 million as of June 30 2017 and 2016. See Tax Bulletin 22-1 for more information. Form IT-225 line 1 Total amount column and enter addition modification A-209 in the Number column.

Impact on your investment returns you may want to use a mutual fund cost calculator to compute how the costs of different mutual funds would add up over time. ENV Envestnet Inc Annual Report 10-k Aggregate market value of registrants common stock held by non-affiliates of the registrant based upon the closing price of a share of the registrants common stock on June 30 2021 as reported on The New York Stock Exchange on that date. 2021 California Exempt Organization Annual Information Return.

Transfer the line 5 amount to Form IT-225 line 10 Total amount column and enter subtraction modification S-214 in the Number column. Deferment of tax and simpler administration for the investor can make these investments attractive to individuals looking for. The trust may be required to file Form 199.

Mark an X in the box if you claimed an investment credit on Form IT-212 Investment Credit for any property.

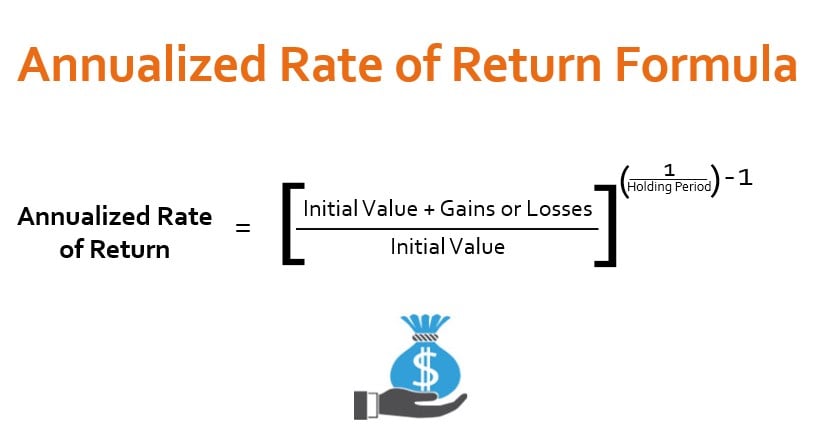

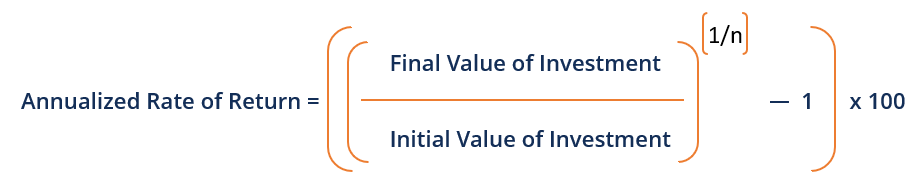

Annual Return Overview Formula Annualized Return

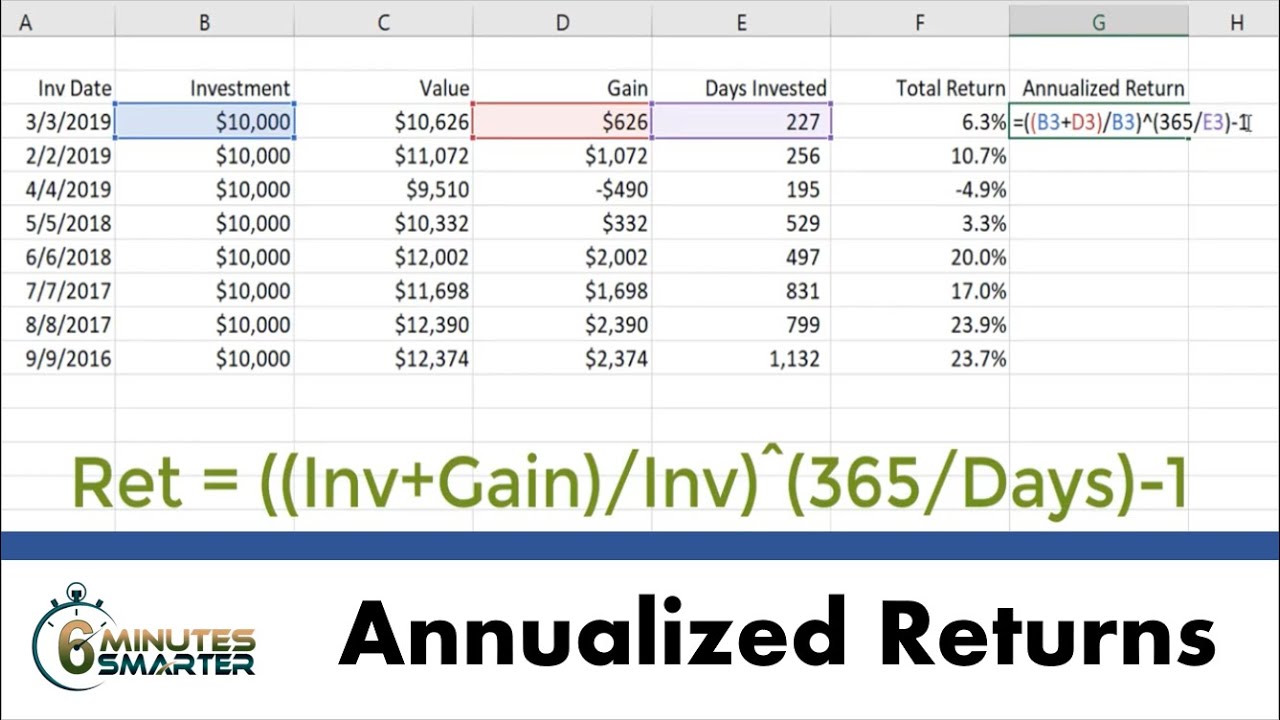

Calculate Annualized Returns For Investments In Excel Youtube

Annualized Rate Of Return Formula Calculator Example Excel Template

No comments for "Compute the Total and Annual Returns on the Described Investment"

Post a Comment